A great financial advisor is enthusiastic about their field and stays current on all aspects of the profession, such as tax laws, investment products, and market trends. These activities directly affect the advisor's performance, and indirectly, the wealth of their clients. These are questions you should ask potential financial advisors.

Reputable studies prove the financial advisors' value

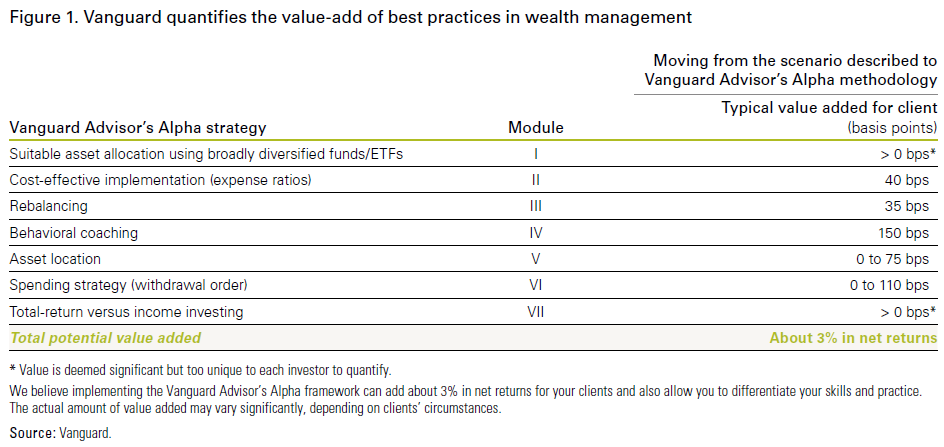

Financial advisors are often questioned regarding their value. Many people consider them to be nothing more than investment managers. Many studies have shown surprising results in quantifying the value of financial advisors. Morningstar and Vanguard conducted these studies. In addition to providing advice, financial advisors can manage risk, manage life events and help you seize opportunities as they come your way.

A behavioral coach can help you add 150 basis points to the portfolio. This is a huge amount of value for turbulent markets. You could lose more money if you make rash or impulsive decisions. Most financial advisors would advise their clients to stick to their investment plan, especially if they have a long time horizon.

Qualities of a competent financial advisor

Canadians are generally confident in their financial knowledge, but many still seek the guidance of financial advisors when dealing with complicated financial issues. An advisor's advice can be invaluable, particularly if you're investing large amounts of money. Choosing a trustworthy advisor is one of the most important financial decisions you can make.

Financial advisers should feel empathy for their clients and communicate clearly with them. They should also be capable of making recommendations that are specific to their clients' goals and requirements. They need to be able assess the risks involved in investing and anticipate potential problems that clients might face. This includes the ability to evaluate new products on market and determine which ones will benefit clients the most. A great financial advisor should also be able speak plainly to clients about their research findings.

Interview questions to screen out poor advisors

It is crucial that you ask the right questions when interviewing a potential financial advisor. Interviews for wealth management will concentrate more on financial concepts, but interviews for financial advisors will focus more upon behavioral aspects. These are 10 questions you can ask your financial advisor. These questions can be used as a guideline to help you prepare for your interview.

First, find out what previous jobs they have held. This is a great way to filter out candidates who view this job as a stepping stone. A great candidate will see it in a giving-and-taking situation, which helps the employer build a company.

Timeliness

There is no stock that is immune from market changes. But there are some stocks that are more likely to outperform than others. These stocks are known as value stock. These stocks have a greater value than their market prices. The Value Line Timeliness rating systems ranks stocks based their expected performance for the next six- to twelve months. This system considers both the safety of the stock, and its price performance.

Financial advisors that are well-informed and able to adapt to market changes will be able make the right adjustments for their clients' portfolios. They should be able and willing to adapt to major life changes, as well as provide extensive research. In addition, a good advisor must possess strong analytical skills. This means being able to read data, identify trends and implement lateral thinking skills. A solid knowledge of economics and mathematics is also required.

Professional approach

The professional approach of financial advisers is essential in establishing a positive relationship with clients. This helps them build trust and increase sales. They must also be able to keep their clients informed and remain aware of their financial situation. They must also have exceptional business development skills. They may be required to collaborate with other members of an organization such as product suppliers and estate agents. This means they will need to be able or willing to negotiate prices with other entities.

Financial advisers use analytical thinking to find the best investments for their clients. This skill allows them to anticipate client needs and make recommendations that will suit their unique situations. They also analyze the risks that may come along with the decisions they make. They are also skilled in assessing new financial products that are available and deciding which ones will be most beneficial to their clients. In addition, they use clear and simple language to explain their research and recommendations.

FAQ

Who Should Use a Wealth Management System?

Everybody who desires to build wealth must be aware of the risks.

It is possible that people who are unfamiliar with investing may not fully understand the concept risk. Poor investment decisions could result in them losing their money.

The same goes for people who are already wealthy. They may think they have enough money in their pockets to last them a lifetime. This is not always true and they may lose everything if it's not.

Each person's personal circumstances should be considered when deciding whether to hire a wealth management company.

How To Choose An Investment Advisor

Selecting an investment advisor can be likened to choosing a financial adviser. You should consider two factors: fees and experience.

An advisor's level of experience refers to how long they have been in this industry.

Fees refer to the costs of the service. It is important to compare the costs with the potential return.

It is crucial to find an advisor that understands your needs and can offer you a plan that works for you.

How can I get started in Wealth Management?

First, you must decide what kind of Wealth Management service you want. There are many Wealth Management service options available. However, most people fall into one or two of these categories.

-

Investment Advisory Services- These professionals will help determine how much money and where to invest it. They advise on asset allocation, portfolio construction, and other investment strategies.

-

Financial Planning Services – This professional will help you create a financial plan that takes into account your personal goals, objectives, as well as your personal situation. They may recommend certain investments based upon their experience and expertise.

-

Estate Planning Services - A lawyer who is experienced can help you to plan for your estate and protect you and your loved ones against potential problems when you pass away.

-

Ensure that the professional you are hiring is registered with FINRA. Find someone who is comfortable working alongside them if you don't feel like it.

What is risk management in investment management?

Risk Management is the practice of managing risks by evaluating potential losses and taking appropriate actions to mitigate those losses. It involves monitoring, analyzing, and controlling the risks.

An integral part of any investment strategy is risk management. The purpose of risk management, is to minimize loss and maximize return.

These are the main elements of risk-management

-

Identifying risk sources

-

Monitoring and measuring the risk

-

How to manage the risk

-

Manage the risk

What is estate planning?

Estate Planning is the process of preparing for death by creating an estate plan which includes documents such as wills, trusts, powers of attorney, health care directives, etc. These documents ensure that you will have control of your assets once you're gone.

Statistics

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

External Links

How To

How to save money when you are getting a salary

Saving money from your salary means working hard to save money. If you want to save money from your salary, then you must follow these steps :

-

It is important to start working sooner.

-

You should cut back on unnecessary costs.

-

You should use online shopping sites like Amazon, Flipkart, etc.

-

Do not do homework at night.

-

Take care of yourself.

-

It is important to try to increase your income.

-

A frugal lifestyle is best.

-

Learn new things.

-

You should share your knowledge with others.

-

Regular reading of books is important.

-

You should make friends with rich people.

-

It is important to save money each month.

-

You should save money for rainy days.

-

It's important to plan for your future.

-

You shouldn't waste time.

-

You must think positively.

-

Negative thoughts should be avoided.

-

Prioritize God and Religion.

-

It is important that you have positive relationships with others.

-

Enjoy your hobbies.

-

Self-reliance is something you should strive for.

-

Spend less than you earn.

-

You should keep yourself busy.

-

It is important to be patient.

-

You should always remember that there will come a day when everything will stop. It's better to be prepared.

-

You shouldn't borrow money at banks.

-

Always try to solve problems before they happen.

-

You should try to get more education.

-

You need to manage your money well.

-

You should be honest with everyone.