Financial representatives can be closely related to securities, commodities, and insurance agents as well as financial advisors. The median annual salary of financial services, commodities, and securities agents was $63,780 as of May 2017. Financial representatives earn between $33,060 to $208,200. Around 90 percent of them are in the middle. The median salary for financial representatives was $187,000.

Job description

Financial representatives should have a job description that includes key responsibilities. These professionals are usually employed by banks or insurance companies. They can sell a wide range financial products. These professionals are responsible for meeting with clients and suggesting the best financial products for their needs. They also monitor market trends. They might also assist clients in opening accounts.

Financial representatives have the responsibility of educating clients on the benefits of different financial products, and for negotiating the right actions to overcome objections. They may also be responsible for providing service to existing clients, including handling policy updates and other concerns.

Salary

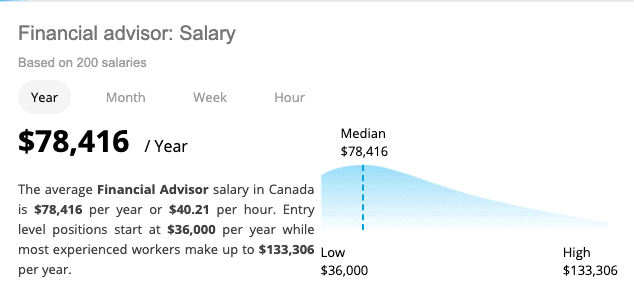

The industry and company that the financial representative works for can have a huge impact on the salary. Some companies offer high-performing employees incentives while others require new hires to earn a minimum salary. A financial representative can also earn a commission for a sales activity or a particular project. A financial representative can also be paid a salary and may receive office space, equipment, or marketing materials.

Robbins Research International is the highest-paid employer for financial agents. National Penn Bank is second. These companies offer up $85,000 per annum.

Requirements

In a career as a financial representative, you will be able to provide clients with a wealth of information to help them make the right financial decisions. As a financial representative, you will be provided with ongoing support and comprehensive training. You can also earn unlimited income potential. Financial representatives typically hold a bachelor's degree or higher and should possess exceptional communication and analytical skills. You should also be comfortable using Microsoft Office applications. To encourage repeat business, you must be able and willing to develop long-term relationships.

A financial representative's income potential depends on how well he or she sells their services. The potential income they can make is directly proportional with the number and quality of their clients. They usually earn their income from renewals, bonuses and commissions.

Employment outlook

According to the BLS, personal financial advisors have a good job outlook. The average growth rate for this occupation is 15 percent, which is faster than average job growth over the next ten years. This growth can be attributed in part to an older population and the fact fewer employers offer traditional pensions and retirement benefits for employees.

FAQ

Is it worth having a wealth manger?

A wealth management service will help you make smarter decisions about where to invest your money. The service should advise you on the best investments for you. This way, you'll have all the information you need to make an informed decision.

Before you decide to hire a wealth management company, there are several things you need to think about. You should also consider whether or not you feel confident in the company offering the service. Can they react quickly if things go wrong? Can they explain what they're doing in plain English?

What is risk management and investment management?

Risk management refers to the process of managing risk by evaluating possible losses and taking the appropriate steps to reduce those losses. It involves identifying and monitoring, monitoring, controlling, and reporting on risks.

Any investment strategy must incorporate risk management. The goal of risk-management is to minimize the possibility of loss and maximize the return on investment.

These are the core elements of risk management

-

Identifying sources of risk

-

Monitoring and measuring risk

-

Controlling the Risk

-

How to manage the risk

How to Beat Inflation With Savings

Inflation refers the rise in prices due to increased demand and decreased supply. Since the Industrial Revolution, when people started saving money, inflation was a problem. Inflation is controlled by the government through raising interest rates and printing new currency. You don't need to save money to beat inflation.

For instance, foreign markets are a good option as they don't suffer from inflation. The other option is to invest your money in precious metals. Silver and gold are both examples of "real" investments, as their prices go up despite the dollar dropping. Investors concerned about inflation can also consider precious metals.

How old can I start wealth management

Wealth Management is best when you're young enough to reap the benefits of your labor, but not too old to lose touch with reality.

The sooner you begin investing, the more money you'll make over the course of your life.

If you are planning to have children, it is worth starting as early as possible.

You may end up living off your savings for the rest or your entire life if you wait too late.

Statistics

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

External Links

How To

How to invest once you're retired

Retirement allows people to retire comfortably, without having to work. However, how can they invest it? The most common way is to put it into savings accounts, but there are many other options. You could also sell your house to make a profit and buy shares in companies you believe will grow in value. You could also choose to take out life assurance and leave it to children or grandchildren.

But if you want to make sure your retirement fund lasts longer, then you should consider investing in property. Property prices tend to rise over time, so if you buy a home now, you might get a good return on your investment at some point in the future. If you're worried about inflation, then you could also look into buying gold coins. They do not lose value like other assets so are less likely to drop in value during times of economic uncertainty.