Blooom is an app which helps investors select the best investments for them. It monitors the account and reviews investments every 95 days. This helps to ensure that your assets are in good condition. To keep an eye on investments, users have the option to set up an automatic, recurring plan. The app also helps you stay on track with your investments by offering a variety of investment options.

Management company for 401(k).

Blooom, a 401k management company, focuses on providing a complete service to its customers. They manage your investments for your benefit and rebalance your portfolio approximately once in ninety days. They can also help you reach your retirement goals and provide general financial advice.

The company works with your 401(k) plan to invest your money in stocks, bonds, or both. This allows you to diversify savings and reduce fees. Blooom will inform you if there are any withdrawals. A free consultation is available via phone or video to evaluate your current investments. Once they have received your information, they will create the ideal investment mix that suits your needs and your risk tolerance.

Blooom offers a plan that will allow you to automate trades. Text alerts can be sent to you when withdrawals and investments are made. You can also have priority live chat access to a financial advisor.

403 (b) Management Company

Blooom is a web-based advisor that specializes on retirement accounts. It is a fiduciary and must act in the client's best interests. It has a low annual cost and no account minimum. It was established in 2013 and has managed assets of more than $1.6 Billion. Blooom, regardless of how large your account is, can help you make smart investment decisions and keep you informed about performance.

Blooom can work with your brokerage account or 401(k), and will recommend the best investments to suit your investment profile. Although Blooom doesn't manage brokerages, it does provide free portfolio analysis, shows hidden investment fees, recommends the right mix and bonds, and even offers to manage them. It also provides financial advice and rebalances portfolios regularly.

Management company for IRAs

Blooom, a professional retirement plan management firm that specializes on employer-sponsored plans, is called Blooom. They offer a variety of options for managing IRAs, including investing in company stock up to 10% of their value. They specialize in employee-sponsored plans. However, they also provide IRA services for those who own an IRA.

Blooom can manage a part or all of your account depending on your needs. They will review your accounts regularly and make automatic changes. They usually review accounts every 95 calendar days and adjust the allocation of funds. Clients can easily connect their existing retirement plan with Blooom, too.

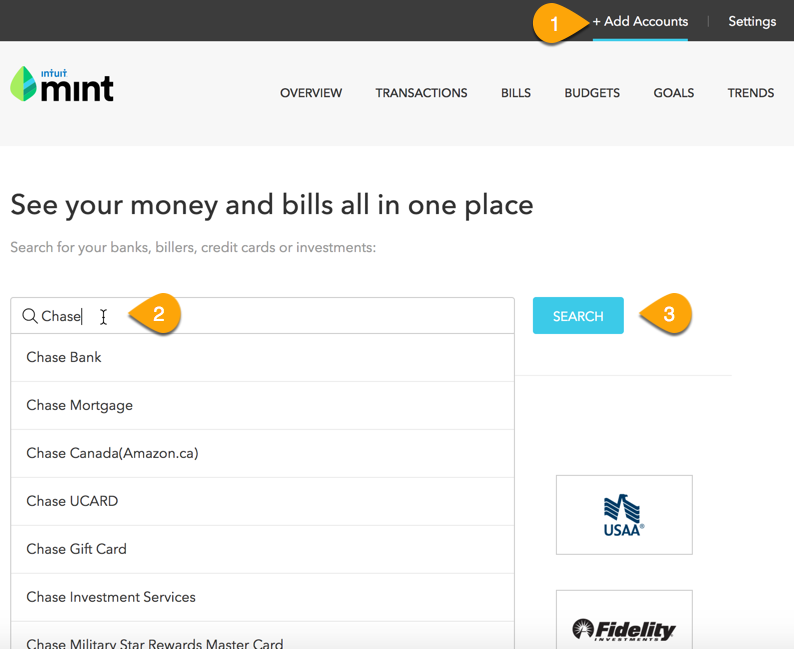

Blooom allows you to invest immediately after signing up. Just click the "Sign Up" link on the main page of the website. You have the option to choose from traditional or Roth IRA accounts as well as a range of employer-sponsored retirement programs. You can also choose from conservative, moderate, or aggressive investment strategies. A free assessment of the risk associated with your investments is available.

FAQ

Is it worth having a wealth manger?

A wealth management service can help you make better investments decisions. You should also be able to get advice on which types of investments would work best for you. This way, you'll have all the information you need to make an informed decision.

Before you decide to hire a wealth management company, there are several things you need to think about. For example, do you trust the person or company offering you the service? Is it possible for them to quickly react to problems? Are they able to explain in plain English what they are doing?

Why is it important to manage wealth?

First, you must take control over your money. It is important to know how much money you have, how it costs and where it goes.

It is also important to determine if you are adequately saving for retirement, paying off your debts, or building an emergency fund.

This is a must if you want to avoid spending your savings on unplanned costs such as car repairs or unexpected medical bills.

What is risk-management in investment management?

Risk Management is the practice of managing risks by evaluating potential losses and taking appropriate actions to mitigate those losses. It involves identifying, measuring, monitoring, and controlling risks.

Investment strategies must include risk management. The goal of risk management is to minimize the chance of loss and maximize investment return.

These are the main elements of risk-management

-

Identifying risk sources

-

Monitoring and measuring the risk

-

Controlling the risk

-

How to manage risk

What are the best ways to build wealth?

You must create an environment where success is possible. You don’t want to have the responsibility of going out and finding the money. If you don't take care, you'll waste your time trying to find ways to make money rather than creating wealth.

Additionally, it is important not to get into debt. It's very tempting to borrow money, but if you're going to borrow money, you should pay back what you owe as soon as possible.

You set yourself up for failure by not having enough money to cover your living costs. And when you fail, there won't be anything left over to save for retirement.

So, before you start saving money, you must ensure you have enough money to live off of.

What Are Some Of The Different Types Of Investments That Can Be Used To Build Wealth?

There are many investments available for wealth building. Here are some examples.

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each has its own advantages and disadvantages. Stocks and bonds, for example, are simple to understand and manage. However, stocks and bonds can fluctuate in value and require active management. However, real estate tends be more stable than mutual funds and gold.

It all comes down to finding something that works for you. It is important to determine your risk tolerance, your income requirements, as well as your investment objectives.

Once you have chosen the asset you wish to invest, you are able to move on and speak to a financial advisor or wealth manager to find the right one.

Statistics

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

External Links

How To

How to Invest Your Savings to Make Money

You can get returns on your capital by investing in stock markets, mutual funds, bonds or real estate. This is what we call investing. This is called investing. It does not guarantee profits, but it increases your chances of making them. There are many ways you can invest your savings. Some of them include buying stocks, Mutual Funds, Gold, Commodities, Real Estate, Bonds, Stocks, and ETFs (Exchange Traded Funds). These are the methods we will be discussing below.

Stock Market

Stock market investing is one of the most popular options for saving money. It allows you to purchase shares in companies that sell products and services similar to those you might otherwise buy. Also, buying stocks can provide diversification that helps to protect against financial losses. In the event that oil prices fall dramatically, you may be able to sell shares in your energy company and purchase shares in a company making something else.

Mutual Fund

A mutual funds is a fund that combines money from several individuals or institutions and invests in securities. These mutual funds are professionally managed pools that contain equity, debt, and hybrid securities. The mutual fund's investment objective is usually decided by its board.

Gold

The long-term value of gold has been demonstrated to be stable and it is often considered an economic safety net during times of uncertainty. Some countries also use it as a currency. Gold prices have seen a significant rise in recent years due to investor demand for inflation protection. The supply-demand fundamentals affect the price of gold.

Real Estate

Real estate is land and buildings. You own all rights and property when you purchase real estate. Rent out a portion your house to make additional income. The home could be used as collateral to obtain loans. The home may also be used to obtain tax benefits. But before you buy any type real estate, consider these factors: location, condition, age, condition, etc.

Commodity

Commodities are raw materials, such as metals, grain, and agricultural goods. As commodities increase in value, commodity-related investment opportunities also become more attractive. Investors looking to capitalize on this trend need the ability to analyze charts and graphs to identify trends and determine which entry point is best for their portfolios.

Bonds

BONDS can be used to make loans to corporations or governments. A bond is a loan agreement where the principal will be repaid by one party in return for interest payments. Bond prices move up when interest rates go down and vice versa. An investor purchases a bond to earn income while the borrower pays back the principal.

Stocks

STOCKS INVOLVE SHARES of ownership within a corporation. Shares only represent a fraction of the ownership in a business. If you have 100 shares of XYZ Corp. you are a shareholder and can vote on company matters. Dividends are also paid out to shareholders when the company makes profits. Dividends are cash distributions to shareholders.

ETFs

An Exchange Traded Fund, also known as an ETF, is a security that tracks a specific index of stocks and bonds, currencies or commodities. ETFs trade just like stocks on public stock exchanges, which is a departure from traditional mutual funds. The iShares Core S&P 500 (NYSEARCA - SPY) ETF is designed to track performance of Standard & Poor’s 500 Index. This means that if SPY is purchased, your portfolio will reflect the S&P 500 performance.

Venture Capital

Venture capital is private financing venture capitalists provide entrepreneurs to help them start new businesses. Venture capitalists lend financing to startups that have little or no revenue, and who are also at high risk for failure. Venture capitalists usually invest in early-stage companies such as those just beginning to get off the ground.