Complex financial decisions are often faced by organizations. These situations require financial expertise that cannot be easily obtained from within the organization. These issues could include acquisitions, restructuring, divestitures or going public. Financial Consulting Services professionals provide objective, specialized advise. Find out more about this role and the education requirements. For more information, please contact us. We are available to answer your questions about the financial advisory industry. Let us help find the right career path to suit your needs.

Financial consultants can expect a job outlook

Financial consultants have a bright future. This field is growing in popularity and there is a high demand for trained professionals. It is not uncommon for financial advisors to earn high salaries. Salary estimates for financial consultants vary depending on geographic region and experience. PayScale estimates that the national average salary for financial advisors is $68,000. However, the top 10% of financial consultants earn more than $106,000. As with any field, there are many ways to prepare for this career.

Jared Ross (a former college professor, financial planner) says the job outlook is great for financial advisers. According to BLS (Bureau of Labor Statistics), this occupation is expected to grow 15% by 2026. This rate is far faster than the average for the nation. There is also a large demand for financial services due to the rapidly aging population. There are fewer pensions and traditional retirement benefits, which makes financial advisors more in-demand.

Financial consultant duties

Financial consultants are responsible for assessing the financial health of a company and recommending strategies to achieve financial goals. These professionals are expected to be up-to-date on all government policies. Financial consultants have many duties, but they require both a bachelor's degree as well as relevant work experience. Internships in financial organizations are required for financial consultants. Internships are a great way for candidates to learn about financial products and process. These professionals need to be able establish rapport with clients.

Aspiring candidates should study accounting before becoming financial consultants. An accounting degree can help an individual keep accurate financial records. A filing system also helps clients track their financial status. A financial consultant will benefit from the training, which will allow them to better understand their clients' finances. A lot of accountants are also skilled in tax preparation, recordkeeping, and other areas. In addition to being an excellent financial consultant, an accountant's knowledge will also help them to manage investments.

Education necessary

The U.S. Bureau of Labor Statistics keeps track of financial consultants. In 2016, there were more than 212,000 financial experts, and 24% who worked for themselves. A degree is required to work as an independent contractor at a financial consultancy firm. This course will help you learn about the career, and will prepare you for a real office environment. Financial consultants offer many benefits.

Financial consulting is a broad field that requires different education. Master's degrees are required for many high-paying roles. An MBA, for instance, is a 4-year degree that builds upon it by focusing on highly-specialized studies. You will learn about financial analysis and how to transform data into gold. You will need to be CFP Board registered if you want to work in financial planning and have clients.

Compensation

Financial consulting work can have a variety of compensation depending on the type and experience of the client. Some financial consulting firms charge 7%, 8% or even 9% of each loan balance's asset multiplier rate. Others may pay a slightly higher percentage depending on the Financial Consultants' experience and past performance. For a $100,000 loan, a Financial Consultant can earn between $40K - $120,000. However, these rules can be broken.

According to the U.S. Bureau of Labor Statistics' May 2011 Occupational Employment Statistics report, the median annual salary for financial consultants was $66,580. The lowest 25 percent earned $43,160 or lower. In contrast, the top 10 percent of financial consultants earned more than $188,000 per year. According to Simply Hired, the average salary for senior financial consultants in the United States was $104,000. Consultants make their money from a portion of their clients' assets, in addition to commissions for financial products they sell.

FAQ

What is a financial planner? And how can they help you manage your wealth?

A financial planner can help you make a financial plan. A financial planner can assess your financial situation and recommend ways to improve it.

Financial planners are highly qualified professionals who can help create a sound plan for your finances. They can give advice on how much you should save each monthly, which investments will provide you with the highest returns and whether it is worth borrowing against your home equity.

Financial planners usually get paid based on how much advice they provide. Some planners provide free services for clients who meet certain criteria.

How to Beat Inflation With Savings

Inflation is the rising prices of goods or services as a result of increased demand and decreased supply. Since the Industrial Revolution, when people started saving money, inflation was a problem. The government regulates inflation by increasing interest rates, printing new currency (inflation). There are other ways to combat inflation, but you don't have to spend your money.

Foreign markets, where inflation is less severe, are another option. There are other options, such as investing in precious metals. Silver and gold are both examples of "real" investments, as their prices go up despite the dollar dropping. Investors who are worried about inflation will also benefit from precious metals.

What is risk management in investment management?

Risk Management is the practice of managing risks by evaluating potential losses and taking appropriate actions to mitigate those losses. It involves the identification, measurement, monitoring, and control of risks.

Risk management is an integral part of any investment strategy. The objective of risk management is to reduce the probability of loss and maximize the expected return on investments.

The key elements of risk management are;

-

Identifying sources of risk

-

Monitoring the risk and measuring it

-

How to control the risk

-

Manage your risk

What are the advantages of wealth management?

Wealth management's main benefit is the ability to have financial services available at any time. To save for your future, you don't have to wait until retirement. It also makes sense if you want to save money for a rainy day.

To get the best out of your savings, you can invest it in different ways.

You could, for example, invest your money to earn interest in bonds or stocks. To increase your income, property could be purchased.

If you use a wealth manger, someone else will look after your money. You won't need to worry about making sure your investments are safe.

Statistics

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

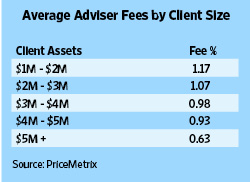

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

External Links

How To

How to Invest your Savings to Make Money

You can earn returns on your capital by investing your savings into various types of investments like stock market, mutual fund, bonds, bonds, real property, commodities, gold and other assets. This is called investing. It is important to realize that investing does no guarantee a profit. But it does increase the chance of making profits. There are many different ways to invest savings. These include stocks, mutual fund, gold, commodities, realestate, bonds, stocks, and ETFs (Exchange Traded Funds). These are the methods we will be discussing below.

Stock Market

The stock market is an excellent way to invest your savings. You can purchase shares of companies whose products or services you wouldn't otherwise buy. Buying stocks also offers diversification which helps protect against financial loss. If oil prices drop dramatically, for example, you can either sell your shares or buy shares in another company.

Mutual Fund

A mutual fund can be described as a pool of money that is invested in securities by many individuals or institutions. These mutual funds are professionally managed pools that contain equity, debt, and hybrid securities. Its board of directors usually determines the investment objectives of a mutual fund.

Gold

The long-term value of gold has been demonstrated to be stable and it is often considered an economic safety net during times of uncertainty. It can also be used in certain countries as a currency. Gold prices have seen a significant rise in recent years due to investor demand for inflation protection. The supply/demand fundamentals of gold determine whether the price will rise or fall.

Real Estate

The land and buildings that make up real estate are called "real estate". You own all rights and property when you purchase real estate. You may rent out part of your house for additional income. The home could be used as collateral to obtain loans. The home may also be used to obtain tax benefits. Before buying any type property, it is important to consider the following things: location, condition and age.

Commodity

Commodities refer to raw materials like metals and grains as well as agricultural products. As these items increase in value, so make commodity-related investments. Investors who wish to take advantage of this trend must learn to analyze graphs and charts, identify trends and determine the best entry point to their portfolios.

Bonds

BONDS ARE LOANS between companies and governments. A bond is a loan agreement where the principal will be repaid by one party in return for interest payments. The interest rate drops and bond prices go up, while vice versa. Investors buy bonds to earn interest and then wait for the borrower repay the principal.

Stocks

STOCKS INVOLVE SHARES in a corporation. Shares represent a fractional portion of ownership in a business. You are a shareholder if you own 100 shares in XYZ Corp. and have the right to vote on any matters affecting the company. When the company earns profit, you also get dividends. Dividends are cash distributions to shareholders.

ETFs

An Exchange Traded Fund or ETF is a security, which tracks an index that includes stocks, bonds and currencies as well as commodities and other asset types. ETFs trade just like stocks on public stock exchanges, which is a departure from traditional mutual funds. The iShares Core S&P 500 eTF (NYSEARCA – SPY), for example, tracks the performance Standard & Poor’s 500 Index. This means that if SPY was purchased, your portfolio would reflect its performance.

Venture Capital

Ventures capital is private funding venture capitalists provide to help entrepreneurs start new businesses. Venture capitalists provide financing to startups with little or no revenue and a high risk of failure. Venture capitalists invest in startups at the early stages of their development, which is often when they are just starting to make a profit.