Connecticut's finance and insurance industry contributes nearly 1/5th of its GDP. Connecticut is also home to many skilled financial advisors. Industry experts carefully choose financial advisors. Benemark, Inc., one example, employs a combination passive and active investment strategies in order to help clients achieve their financial dreams.

Coastal Bridge Advisors

Coastal Bridge Advisors, a registered investment advisor, offers sophisticated and highly personal advice. Coastal Bridge, which was established in 2008, combines the best of both a boutique and large-scale firm capabilities to create productive client relationships. The firm offers a variety of strategies that span generations, markets, and geographies.

The company's principals have a wealth of industry experience and are committed to providing clients with personalized service. They work closely with clients in order to develop and implement an investment strategy and a comprehensive wealth management plan that fits their lifestyle. The firm's management team has invested in technology, operations, and client service solutions to help clients make informed decisions.

GYL Financial Synergies

GYL Financial Synergies, LLC, a financial advisory firm, is located in West Hartford, Connecticut. It serves clients across 27 states and manages over $5 billion in 4693 accounts. This firm focuses on retail investors, high-net-worth individuals, pension plans, and state and municipal government entities.

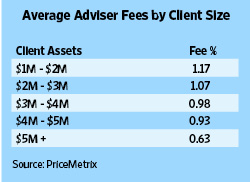

The firm charges fees based on the type of service it provides. The firm may charge hourly, asset-based, or fixed fees depending on the type of service it provides. It may also be a member of a wrap-fee programme, which bundles many services under one fee.

Johnson Brunetti

Johnson Brunetti, an independent retirement planning company with offices in Connecticut and Massachusetts offers neighborhood service. The company was founded on the principles and trustworthiness of integrity and trustworthiness. They focus on helping clients gain confidence in their financial future. With our help, you can put your financial future in the hands of experts who are fully committed to your well-being.

Johnson Brunetti is headed up by Joel Brunetti. This wealth management firm specializes in retirement and investments. He is a Certified Personal Financial Planner(tm), with more than 15 year experience in financial planning. He is not only a certified financial professional, but also has the Series 65 license and is licensed in Connecticut as a life and health agent. He also enjoys travel and time spent with his three kids.

Reed Financial Planning Services LLC

Reed Financial Planning Services LLC is a Connecticut-based independent wealth management firm that specializes in retirement income planning and health insurance. The firm currently manages 33 client accounts, with an AUM of $16,073,317. It offers pension consulting and other financial services. The firm is a member of the Voya Field Advisory Board.

Jeremy Reed is a registered financial advisor at Wells Fargo Advisors. He helps clients to discover their personal retirement vision. He works closely with individuals, families and businesses to help them create a personalized plan that achieves their financial goals. To help his clients achieve their dreams, he uses the extensive resources of Wells Fargo Advisors.

FAQ

How to Choose An Investment Advisor

Choosing an investment advisor is similar to selecting a financial planner. Consider experience and fees.

This refers to the experience of the advisor over the years.

Fees refer to the costs of the service. It is important to compare the costs with the potential return.

It is essential to find an advisor who will listen and tailor a package for your unique situation.

What is risk management in investment management?

Risk Management refers to managing risks by assessing potential losses and taking appropriate measures to minimize those losses. It involves the identification, measurement, monitoring, and control of risks.

Risk management is an integral part of any investment strategy. The goal of risk management is to minimize the chance of loss and maximize investment return.

These are the main elements of risk-management

-

Identifying risk sources

-

Monitoring and measuring risk

-

Controlling the Risk

-

Manage the risk

Is it worth having a wealth manger?

A wealth management service will help you make smarter decisions about where to invest your money. You can also get recommendations on the best types of investments. You'll be able to make informed decisions if you have this information.

Before you decide to hire a wealth management company, there are several things you need to think about. For example, do you trust the person or company offering you the service? Can they react quickly if things go wrong? Can they clearly explain what they do?

How to Beat the Inflation with Savings

Inflation can be defined as an increase in the price of goods and services due both to rising demand and decreasing supply. Since the Industrial Revolution, people have been experiencing inflation. The government regulates inflation by increasing interest rates, printing new currency (inflation). But, inflation can be stopped without you having to save any money.

For instance, foreign markets are a good option as they don't suffer from inflation. An alternative option is to make investments in precious metals. Two examples of "real investments" are gold and silver, whose prices rise regardless of the dollar's decline. Investors concerned about inflation can also consider precious metals.

Statistics

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

External Links

How To

How to Invest Your Savings to Make Money

You can generate capital returns by investing your savings in different investments, such as stocks, mutual funds and bonds, real estate, commodities and gold, or other assets. This is what we call investing. You should understand that investing does NOT guarantee a profit, but increases your chances to earn profits. There are many options for how to invest your savings. Some of them include buying stocks, Mutual Funds, Gold, Commodities, Real Estate, Bonds, Stocks, and ETFs (Exchange Traded Funds). We will discuss these methods below.

Stock Market

The stock market is an excellent way to invest your savings. You can purchase shares of companies whose products or services you wouldn't otherwise buy. Buying stocks also offers diversification which helps protect against financial loss. You can, for instance, sell shares in an oil company to buy shares in one that makes other products.

Mutual Fund

A mutual fund is a pool of money invested by many individuals or institutions in securities. They are professionally managed pools with equity, debt or hybrid securities. The mutual fund's investment objective is usually decided by its board.

Gold

It has been proven to hold its value for long periods of time and can be used as a safety haven in times of economic uncertainty. Some countries also use it as a currency. Due to the increased demand from investors for protection against inflation, gold prices rose significantly over the past few years. The supply and demand factors determine how much gold is worth.

Real Estate

Real estate can be defined as land or buildings. When you buy realty, you become the owner of all rights associated with it. To generate additional income, you may rent out a part of your house. You may use the home as collateral for loans. The home can also be used as collateral for loans. However, you must consider the following factors before purchasing any type of real estate: location, size, condition, age, etc.

Commodity

Commodities are raw materials like metals, grains, and agricultural goods. As these items increase in value, so make commodity-related investments. Investors who want the opportunity to profit from this trend should learn how to analyze charts, graphs, identify trends, determine the best entry points for their portfolios, and to interpret charts and graphs.

Bonds

BONDS are loans between corporations and governments. A bond is a loan where both parties agree to repay the principal at a certain date in exchange for interest payments. Bond prices move up when interest rates go down and vice versa. An investor purchases a bond to earn income while the borrower pays back the principal.

Stocks

STOCKS INVOLVE SHARES of ownership in a corporation. A share represents a fractional ownership of a business. If you own 100 shares, you become a shareholder. You can vote on all matters affecting the business. You also receive dividends when the company earns profits. Dividends refer to cash distributions made to shareholders.

ETFs

An Exchange Traded Fund (ETF) is a security that tracks an index of stocks, bonds, currencies, commodities, or other asset classes. ETFs can trade on public exchanges just like stock, unlike traditional mutual funds. The iShares Core S&P 500 Exchange Tradeable Fund (NYSEARCA : SPY) tracks the performance of Standard & Poor’s 500 Index. This means that if you bought shares of SPY, your portfolio would automatically reflect the performance of the S&P 500.

Venture Capital

Venture capital is private funding that venture capitalists provide to entrepreneurs in order to help them start new companies. Venture capitalists provide financing to startups with little or no revenue and a high risk of failure. Venture capitalists typically invest in companies at early stages, like those that are just starting out.